Don’t Settle for Just Any Law Firm in Middle Tennessee

Your legal matters deserve more than just a one-size-fits-all approach. Let us guide you through the complexities of the law tailored to your needs and goals.

Chelle Z.

“Shawn and Martha have been great!! We needed someone who is down to earth and yet able to translate contracts so that we knew what we were getting and giving. Shawn has been honest and willing to take the necessary steps to protect us and our business. Definitely recommend for business contract law!!”

Our Services

Conservatorship

Let our skilled attorneys provide the compassionate guidance and advocacy you need for all aspects of conservatorship.

Wills, Trusts, Estate Planning & Probate

Protect your legacy with our expert estate planning and probate services.

Business & Commercial Law

McBrien | Armistead Law Group provides counsel to businesses of all sizes, to help you start, grow or sell.

Civil Litigation

Contract disputes, business dissolutions, construction, property disputes and general litigation are at the forefront of our practice.

Mediation

Experienced mediator Shawn McBrien offers effective dispute resolution helping parties reach settlements and move forward.

Elder Law

We assist senior clients in Middle Tennessee who may face unexpected legal challenges related to elder care.

Attorneys you can trust

Our experienced team covers the legal issues you need help with — get to know us and reach out for a free consultation.

Our AttorneysWhy You Should Choose

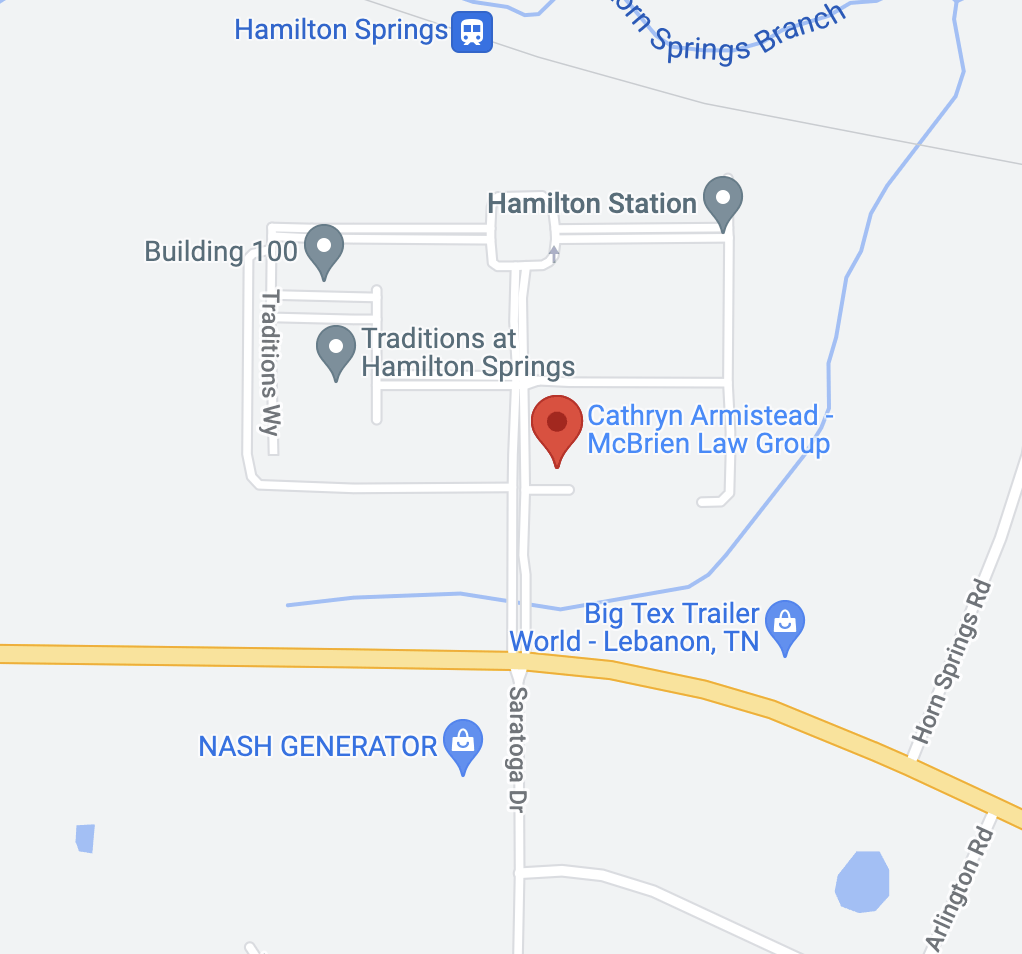

McBrien | Armistead Law Group

We have years of experience representing clients in Middle Tennessee and are familiar faces in the Courts where we practice. As a result, our familiarity with the local courts and procedures keeps costs down for clients.

Despite having busy caseloads, we strive to maintain a small firm feel and to be accessible to all of our clients. We are exceptionally well versed in our practice areas and believe that by focusing on specialized areas rather than taking every case that walks in the door, we can provide outstanding representation and serve our clients to the best of our abilities. We invite you to explore our resources, learn more about our law firm, or contact us to schedule a consultation.

About Us